Not known Details About Stop Wage Garnishment in Virginia

And two, he can repeat the garnishment indefinitely forcing you to definitely exhaust your homestead and ultimately earning you switch over money after your homestead is exhausted.

This post focuses solely on Wages. Judgment creditors can also try out to gather by attaching funds in the banking account or asking the sheriff to provide a few of your own residence (like cars and furnishings).

Option number 1 is generally never an excellent selection for two causes: 1) The personal debt is legitimately owed and whilst there could happen to be a defect in serving notice with the lawsuit reopening the case will for most circumstances cause the identical result, a judgment and talent to garnish.

Wage garnishment in Virginia can come about if you’re unable to keep up with debt payments. Creditors can file a lawsuit to garnish your wages, As well as in Virginia

No matter if you are presently dealing with a garnishment or are only just falling behind on payments, they could possibly work with all your creditors with your behalf to come up with a payment system or produce a debt management program if vital.

Creditors ought to very first sue you for unpaid credit card debt. Should they get the case, they’ll receive a court docket purchase enabling them to garnish your wages.

three. File for personal bankruptcy to stop the garnishment rapidly. 4. Achieve out into a nonprofit to ask for economical aid. Obtaining your wages garnished lessens your disposable profits and may really feel very annoying. But remember, you may have rights and there are methods to stop the garnishment.

Non-public creditors almost always have to obtain a court docket-requested garnishment to start out attaching a debtor’s wages. The kinds of debts involved are limitless, but most often slide into amongst the next types:

Use Experian Increase® to get credit history for that charges you presently pay like utilities, cell phone, video streaming products and services and now lease. Commence your boost No charge card demanded

There are lots of strategies to stop wage garnishment that may hopefully bring about credit card debt reduction and enhance your credit history score and General funds in the process.

Even though filing for bankruptcy is one method to stop wage garnishment, personal bankruptcy just isn't proper for everyone. Getting in contact with a bankruptcy law firm is alway a superb alternative For those who have questions about the individual bankruptcy approach, financial debt consolidation, more helpful hints or are looking for normal legal advice.

Let's say I skipped the deadline? Frequently, you should nonetheless try and file. When you skipped your deadline, there remains to be a very good prospect your court docket will settle for your Respond to. Courts may accept an Answer once the deadline has handed, right until default judgment is submitted by the person suing you. What’s incorporated? It is possible to make your Response without cost, then Go Here pay out us to possess a legal professional evaluation the document and also to file for yourself. Am i able to see a sample? Indeed, this is a sample Financial debt Response. Would you provide try this website the individual suing me? Sure, we mail a copy of your respective Answer through mail into the attorney of the person suing you. How quickly are you able to file for me? For a normal package it will take us one-eight days. For Quality it's going to take one-6 days. For many orders, we file by mail.

Understand the automatic continue to be. go to this website As soon as you file for personal bankruptcy, an “computerized remain” is issued to all creditors. This stay halts any selection initiatives taken or about to be taken by creditors. Appropriately, the automated keep can stop most garnishments.[9] X Investigation source

You can find 4 direct means you normally takes action to stop a wage garnishment: 1. Check out to negotiate a look at here payment strategy with your creditor(s) or settle your personal debt. 2. Obstacle the wage garnishment in court docket.

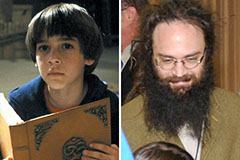

Barret Oliver Then & Now!

Barret Oliver Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Seth Green Then & Now!

Seth Green Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!